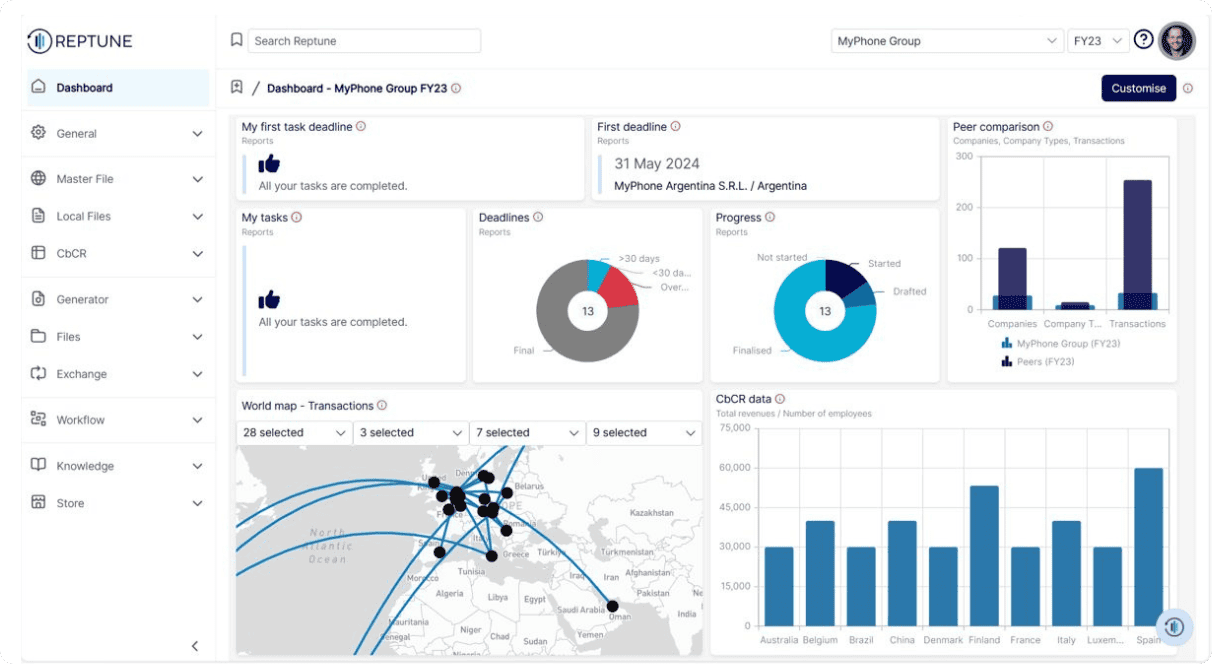

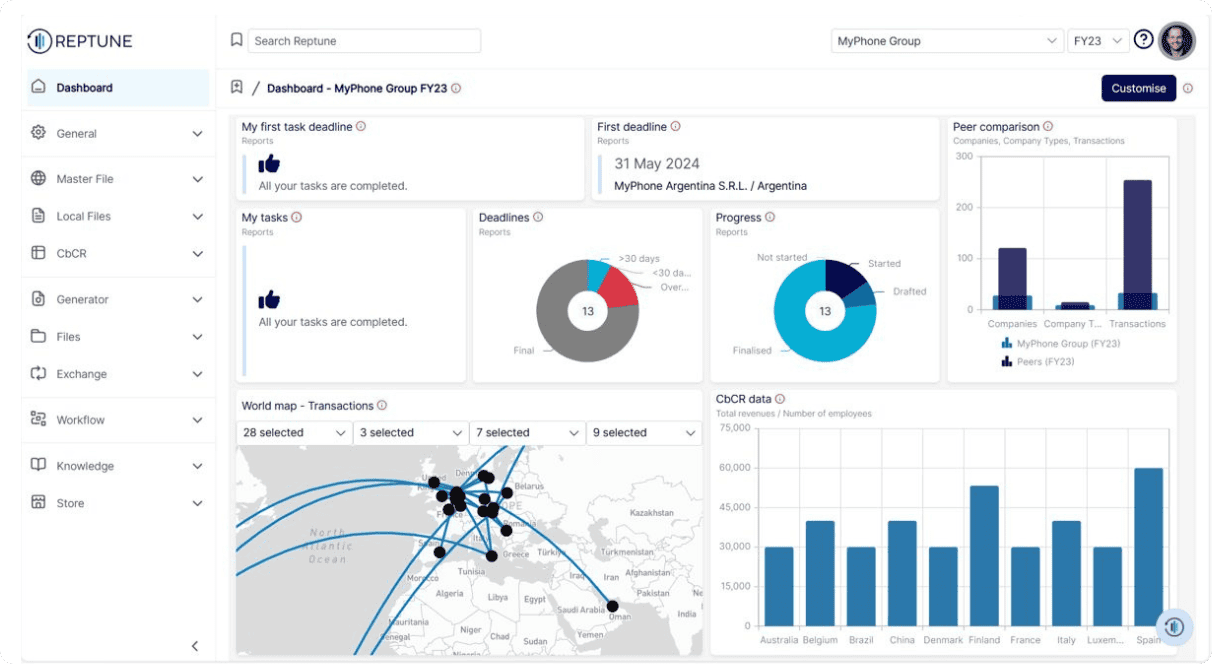

Transfer Pricing Documentation Made Easy

We provide global Transfer Pricing Documentation services and software, in a cost-efficient way to enable compliance and control.

We provide global Transfer Pricing Documentation services and software, in a cost-efficient way to enable compliance and control.